Loan Resource Center

Manage your loan wherever you are, whenever you want. Digital banking with Old National makes it easy. For additional help, you can also visit us at a banking center, call Client Care, or check out our FAQs below.

Manage your loan wherever you are, whenever you want. Digital banking with Old National makes it easy. For additional help, you can also visit us at a banking center, call Client Care, or check out our FAQs below.

Don’t have digital banking yet? Enroll now.

Don’t forget eStatements!

You can enroll through digital banking.

Manage your loan from your smartphone or tablet. Find the Old National Mobile App on:

Simply search for “Old National Mobile” if the above links don’t take you straight there.

Frequently Asked Questions

If you have a mortgage questions, please visit our Mortgage Manager page.

Manage Your Loan

A: You can access your loan through our Digital Banking services. There are several options for enrolling online:

Once on the enrollment page:

If you choose to register your device as a trusted (i.e., private, nonpublic) device, you will not be required to complete the verification process each time.

A: To find and download the Old National Mobile App:

There is no charge for use of the Old National Mobile App.

If you need assistance with downloading the Old National Mobile App, please call Client Care at 1-800-731-2265.

A: eStatements are online, electronic copies of your account statements that you can quickly view, search, save and print. You can view them on your computer and your mobile device.

To enroll in eStatements through Online Banking or the Mobile App, just follow these simple steps:

On a web browser

On the Old National Mobile App

Enrolling in eStatements from your our Mobile App is similar.

Note that enabling eStatements will stop the delivery of a paper statement to your mailing address.

If you need assistance with signing up for eStatements or using them, please contact Client Care at 1-800-731-2265.

A: Following are some options for obtaining your loan number:

A: To change your mailing address, Old National offers several options:

To change your phone number or email address:

Please note that changes can only be applied to the information for the person requesting the change. If there are additional people listed on the account, those individuals will need to request updates for their own information.

Payment Questions

A: For personal loan payments (not including mortgage loans), we offer several options:

A: For personal loans, such as auto loans:

If you need assistance setting up an automatic loan payment or want us to mail an auto pay form to you, please contact Client Care at 1-800-731-2265 or visit any Old National banking center.

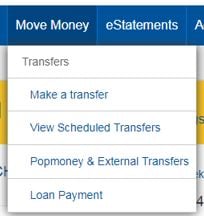

A: Yes, we provide options to pay on your Old National loan from a checking account outside of Old National.

You will be taken to a screen where you can input information for the external account you want to take your payment from. Please note that the account at another financial institution will need to be verified, so you may not be able to make your payment immediately.

Note: Currently, only mortgage loans can be paid from within the ONB Mobile App.

A: To request a change in your payment due date, please call Client Care at 1-800-731-2265, Option 4.

A: Payments will typically post to your account the day they are received, depending on how you made your payment.

A: Not at this time. For payoff information, please call Client Care at 1-800-731-2265, Option 4, or visit any Old National banking center.

Please note that loan payoff amounts over $3,500 must be paid in a banking center and cannot be accepted over the phone.

Amounts under $3,500 can be accepted by phone as an electronic check (eCheck) only, and not by credit card or debit card. There is also a fee associated with loan payments made by phone. You will need to have your routing number and account number to pay by eCheck.

A: For the correct amount to pay off a loan, please call Client Care at 1-800-731-2265, Option 4, or visit any Old National banking center.

A loan's payoff information is not available within Online or Mobile Banking. The remaining balance shown on a loan within Online and Mobile Banking may not reflect all interest, fees, payments, etc. To obtain the correct amount to pay off a loan, it is best to call us or visit a banking center.

A: We are not able to stop a single payment, but we can cancel the entire automatic payment service at your request. You can re-establish automatic payments when you are ready.

Old National must receive your request at least 5 business days prior to the payment due date.

Requests to cancel automatic payments can be submitted by completing our Consumer Loan Auto Pay form and either returning it to a banking center or mailing it to PO Box 3728, Evansville, IN 47736.

Please note that late payment fees may apply if we do not receive your loan payment by the due date.

If you have questions or need assistance, please call Client Care at 1-800-731-2265.

A: We are here to discuss any options available to you. Please contact our Client Care at 1-800-731-2265, Option 4.

General Questions

A: If you have not received your coupon book, or misplaced it, you can request a new one in one of these ways:

A: Contact Client Care at 1-800-731-2265, Option 4, or visit any Old National banking center to receive detailed information regarding your loan.

1 Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

This is a link to a third-party site. Note that the third party's privacy policy and security practices may differ from the standards of Old National Bank. Complete details regarding third-party links are available in our Terms of Use.

Residents of California have certain rights regarding the sale of personal information to third parties. Old National Bank, our affiliates, and service providers use information collected through cookies or in forms to improve the experience on our site and pages, to analyze how our site is used, and to present personalized advertising.

At any point, you can opt-out of the sale of your personal information by selecting Do Not Sell My Personal Information.

You can find more information and how to manage your privacy choices by reviewing our California Consumer Privacy Disclosures located on our Privacy information page by following the link on the bottom of any page.