Money Market vs CD: How To Decide

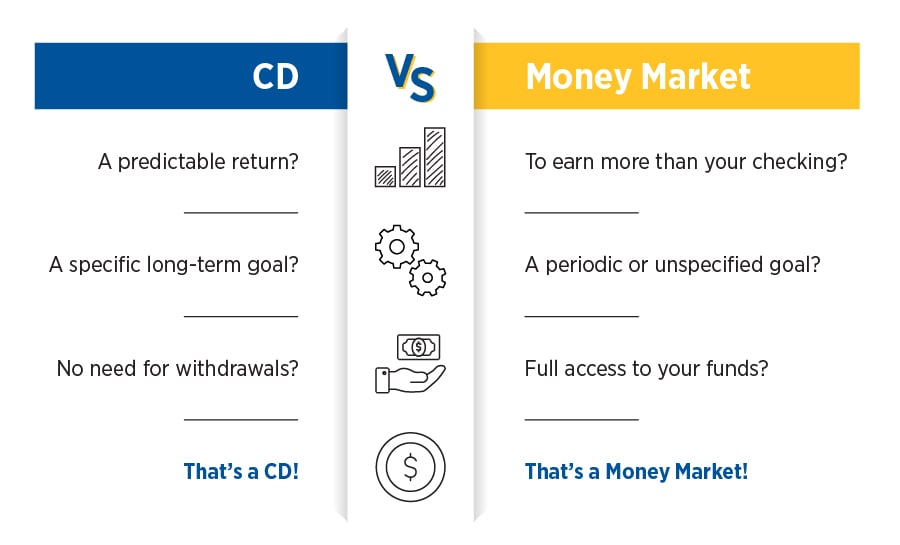

There are several differences between a Certificate of Deposit (CD) and a money market account. But, the key is really about your intentions. What are you planning to do with the money you're saving? If you can answer that question, choosing between a CD and money market account should follow naturally.

CD or Money Market

What are your savings plans?

When You Might Choose a CD

If you're thinking of something far off or very specific, like a young teen's college tuition or a big vacation in 10 months, and you're sure you won't need any of the funds earlier, a CD often makes the most sense. CDs typically have the highest rate of all savings accounts and your earnings are locked in. Plus, you can often use them for short-term savings: CDs can have terms as short as 3 months.

When You Might Choose a Money Market Account

If you're thinking you want to earn interest on money you use more regularly, or that you might need to withdraw funds suddenly, a money market account often makes more sense. For example, if you're house-hunting, it makes sense to build your savings and earn a return while you search, with the flexibility to withdraw funds when you need the downpayment. Or, a money market account is a great solution for your emergency fund: you earn a return on funds you need to keep separate—but you also can access the funds penalty-free, should you need them.

The Difference Between a CD and Money Market Account

How a Certificate of Deposit (CD) works. You essentially loan your money to the bank for the term of the CD. Terms can be as short as three months, or as long as five years or more. In return, you earn a fixed rate that's typically among the highest among all savings account types. The catch is that you can't access your money during the term without paying an early withdraw penalty. So, when you choose a CD, you want to be sure you don't need the money in the interim.

How a money market account works. It's almost like a checking account with higher interest. You can add and subtract funds easily and you can often write checks from the account. What's not to like? The catch is that there are often minimum amounts required to earn a return, or there's a monthly maintenance fee (that may be waived if you keep your funds high). While the flexibility is nice, with a money market account you want to make sure you actually have enough funds to make it worth your while.

Pros of Both a CD and a Money Market Account

Earn a return. You can enhance your savings very quickly by moving unused funds that were previously earning no (or very little) interest into a CD or money market account. It's a simple and easy way to earn a return on funds that otherwise weren't earning.

Low risk compared to other investments. Compared to blue-chip stocks, a real estate investment, or valuables like watches or gold, both CDs and money market accounts are extremely low risk. They do not go down in value (excluding the possibility of early withdraw penalties (CDs) or funds lost in fees (money market)) while offering a competitive return.

Fully insured by the FDIC. With both a CD and a money market account, your funds are fully insured through the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor, per account ownership type. That's an incredible amount of security!

Possible Cons of CDs and Money Market Accounts

While earning interest in an insured account is a huge pro, there are aspects to both money market accounts and CDs that you should consider.

Things to Know About CDs

- The early withdrawal penalty can be steep. Just make sure you're sure before you pull the trigger.

- Locking in a rate could backfire. If rates go up, locking in a rate won't feel as good.

- Tying up money comes with an opportunity cost. Sometimes investing in the stock market or some other potentially higher-yielding option may make more sense.

Things to Know About Money Market Accounts

- Fees could bog you down. Make sure you understand the rules of your money market account, so you can maximize your earnings by avoiding fees.

- Rates can change. If the rate environment goes up, you could earn more. But if rates go down, you'll earn less. With flexibility comes more variability.

- You might need a large amount of funds to earn. Interest tiers, or threshold amounts below which you don't earn, or a relatively large amount required to open the account, may mean that earnings may not be as accessible as you hoped.

Your Savings: CDs and Money Market Accounts are Solid Options

Whether you choose a CD or a money market account, you'll be doing yourself a favor: you'll be saving for your future. You'll be doing so in an FDIC-insured account, and you'll be earning a return on your funds. Which one you choose all depends on what you need.

If you're looking to maximize your return and don't need your funds soon, a Certificate of Deposit probably makes the most sense. If you're looking for a return, while retaining the flexibility to withdraw from an deposit into the account, a money market option may be the right choice.

The specific product you choose may also depend on the rates available. Many banks will share their highest rate options, or any promotions they have. For example, at Old National, we share our savings rates on one page, so you can compare and contrast.

If you have further questions, your friendly Old National banker would be happy to help. Just stop in a local banking center or make your appointment today!