Fixed Income Fund Flows Dominant Over Equities Amid Recession Threat

Fund flows into taxable bond funds and ETFs continue to trump equity funds and ETFs into the late year, reported Lipper Alpha Insight.

Investors are preparing for a further deceleration in the US economy by plowing more than $262.1 billion into taxable bond funds (including ETFs) year to date, versus $150.3 billion into equity funds during the same period.

"Fund investors have been in a risk-off mode for most of 2019 despite stellar stock market returns, injecting $430.8 billion into money market funds year to date. However, for the Lipper fund-flows week ended November 20, 2019, investors were net redeemers of money market funds—withdrawing $25.3 billion (their largest weekly net outflows since April 17, 2019).

The conservative nature of mutual fund investors continued. For the fortieth consecutive week, conventional fund (ex-ETF) investors were net redeemers of equity funds, withdrawing $3.7 billion during the most recent fund-flows week. In contrast, ETF investors continued to be a little more aggressive, injecting net new money for the sixth consecutive week into equity ETFs (+$898 million this past fund-flows week). Combined with the $898 million inflow for equity ETFs, this left investors as net redeemers of equity funds (-$2.8 billion).

Year to date, the difference between conventional equity fund investors and equity ETF investors is quite striking, with the former withdrawing a net $210.9 billion, while the latter injected a net $60.6 billion. That said, both investor types have gravitated towards fixed income, with conventional fund investors and ETF investors injecting $157.2 billion and $104.9 billion, respectively, year to date. For the most recent fund-flows week, fund investors (including ETFs) were net purchasers of taxable fixed income funds (+$12.4 billion, their largest weekly net inflows since February 4, 2015) and municipal bond funds (+$2.0 billion).

With the Federal Reserve cutting its key lending rate for the third time this year in October, investors continued their search for yield and appeared to be willing to put a little more risk on. Core Bond Funds (+$92.4 billion, including ETFs) have attracted the lion's share of net new money year to date, followed by Core Plus Bond Funds (+$26.9 billion), Multi-Sector Income Funds (+$26.0 billion), and Corporate Debt BBB-Rated Funds (+$21.5 billion).

Investors looking for bond funds that have a liberal investment mandate with a go-anywhere feel to them have been looking at flexible income and flexible portfolio funds, which have taken in a net $21.9 billion combined. For the most recent fund-flows week, flexible funds attracted the largest draw of net new money of any taxable fixed income macro-groups, attracting $5.7 billion (its largest weekly draw since Lipper began providing weekly flows back in 1992)," Lipper Alpha Insight wrote.

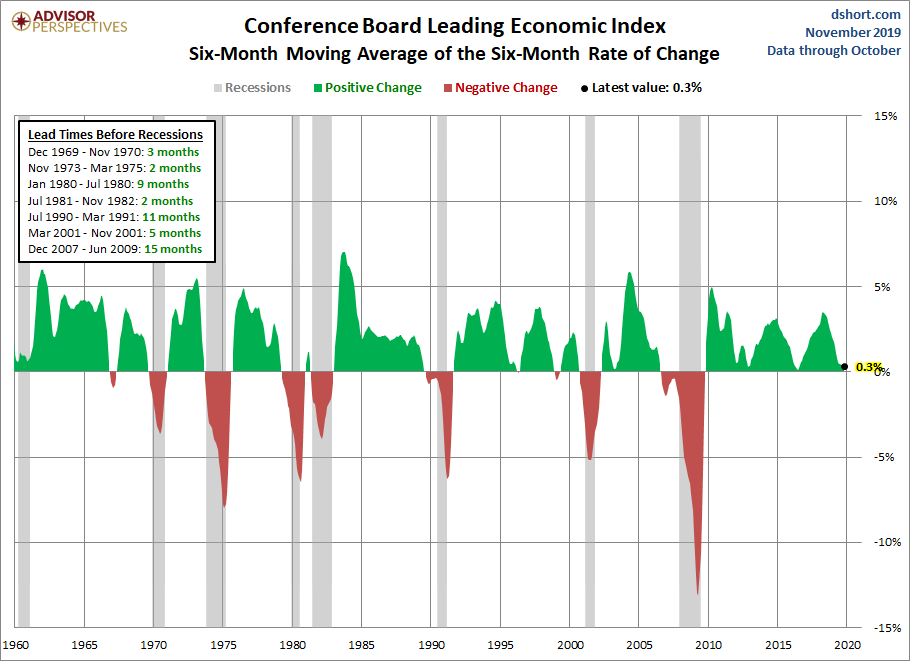

Investors have been defensive since late 2018 when the US economy entered its fourth deceleration in growth since 2009.

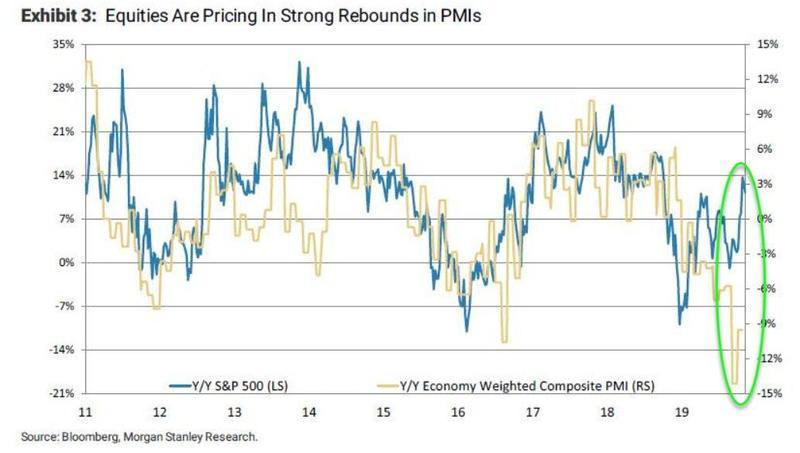

Though equities have hit new highs on "trade optimism" and soaring central bank money printing, a large divergence has appeared where equities have already priced in a strong recovery for early 2020.

The risk today, and that's why smart money continues piling into bonds, is that the US economy continues to decelerate into early 2020, as it could appear the equity market has priced in a recovery that may not pan out, which could lead to another repricing event for stocks, in the coming months.

This article was written by Zero Hedge from Blockchain News and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to legal@newscred.com.