How This DTC Furniture Brand Takes A Proactive Approach To Solving Supply Chain Issues

Across the United States and a number of other countries, extremely long delivery times, due to the effects of Covid-19 related disruptions, are still leaving furniture shoppers anxiously awaiting their coveted furniture purchases for weeks and months on end. Most recently, Modloft, a now multi-million-dollar furniture business, sold out of a year's worth of inventory in just 2 months due to the high demand and from 2020-2021 its sales growth exceeded 133%!

I had the pleasure of speaking with Modloft’s founder, Ted Toledano about the current challenges businesses are facing due to the supply chain issues and how the DTC brand proactively solved these issues.

Gary Drenik: Can you share some background on Modloft's production prior to the supply chain crisis?

Ted Toledano: Pre-pandemic, Modloft spread production across multiple continents, building products in the countries of origin that specialize in those raw materials, like glass from Italy or wood from Brazil.

Drenik: Did manufacturing start to take longer, were there factory shutdowns that affected business?

Toledano: Yes, the manufacturing lead times from our partners first doubled and then ballooned four times as they had been hampered by everything from pandemic-caused shutdowns to worker shortages. The factory outbreaks, and subsequent shutdowns, had a tremendous negative impact on the brand’s product supply.

Drenik: How was Modloft able to combat these issues?

Toledano: Definitely was not easy! The challenge led us to onshore manufacturing, in both the US and Mexico. At the expense of higher margins, producing in North America allows us to bypass international shipping bottlenecks, get product in our warehouse faster, maintain lower levels of inventory, and deliver a better customer experience – far outweighing the higher product costs.

Additionally, we continue to invest in supply chain automation, including more solutions that span the supply chain ecosystem, connecting supply, demand, inventory optimization, fulfillment optimization, and so on. Warehouse automation solutions will depend on software to provide the flexibility to handle fluctuations in demand.

Drenik: How has Modloft been able to think ahead in terms of what people will be shopping for given the delays?

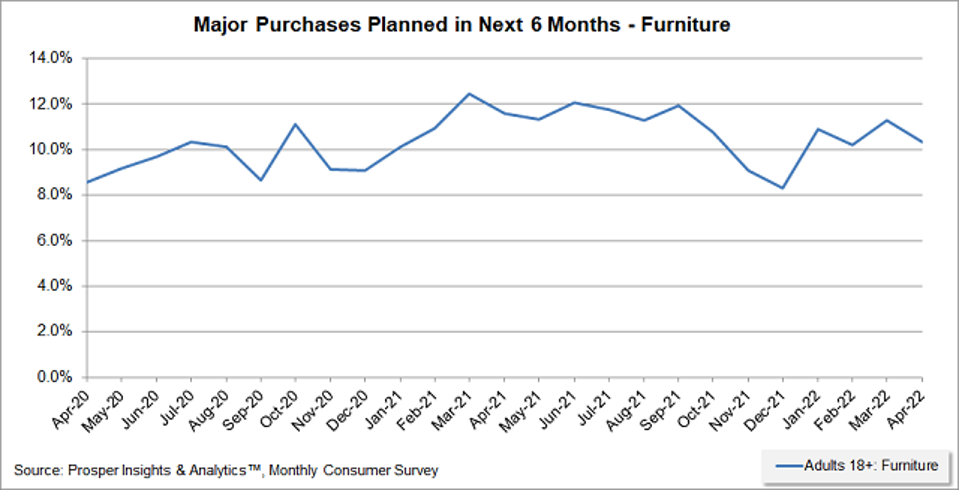

Toledano: Consumers have had an increased focus on their homes and as such, have been willing to pay more on their interiors valuing quality over everything and it’s only continuing. According to a recent Prosper Insights & Analytics survey, 10.3% of consumers plan to purchase furniture in the next 6 months compared to 8.6% at the onset of the pandemic.

Prosper Insights & Analytics

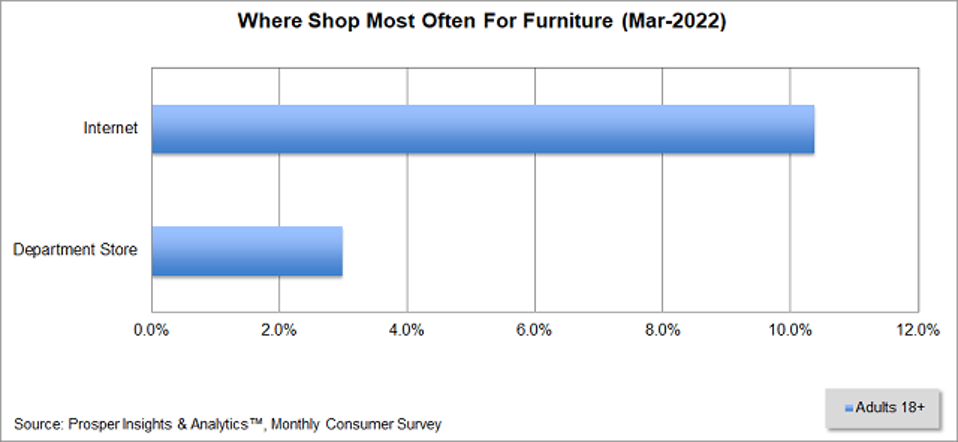

Additionally, we have seen now that only 3% of consumers are shopping for furniture at department stores, whereas 15% are shopping online.

Prosper Insights & Analytics

Drenik: Have the industry-wide delays changed your strategy moving forward?

Toledano: Entirely. Gone are the days of stable demand planning and forecasting. Beyond delays, the costs associated with importing products are growing prohibitive, with no end in sight. There is an industry-wide effort to get products made closer to home. That is currently possible in some product categories, but not in others. Solving the “other categories” is part of the strategy moving forward.

Drenik: Thanks, Ted, for taking the time to speak about this. Looking forward to seeing how Modloft will continue to grow after the pandemic and what’s in store for you next.

This article was written by Gary Drenik from Forbes and was legally licensed through the Industry Dive Content Marketplace. Please direct all licensing questions to legal@industrydive.com.