Markets Gain Clarity as Election Dust Settles

As the dust settles on the hotly contested Presidential race, financial markets are responding to the outcome and its potential implications for the economy and various sectors. Let's examine the top five takeaways from post-election news in no particular order.

Currencies

The U.S. dollar (USD) saw its best day since 2022 earlier this month, gaining post-election momentum as growth and inflation expectations rose. A surge in U.S. Treasury yields increased the attractiveness of the USD versus major global currencies. The initial reaction of renewed inflation concerns, followed by a pickup in interest rates and dollar strengthening are highly dependent on policy implementation. We expect further currency volatility as markets continue to digest global economic factors related to the incoming administration, balanced against global central bank easing. For those seeking to manage divergent macro trends, alternative strategies, particularly multi-strategy investments, could be a potential option.

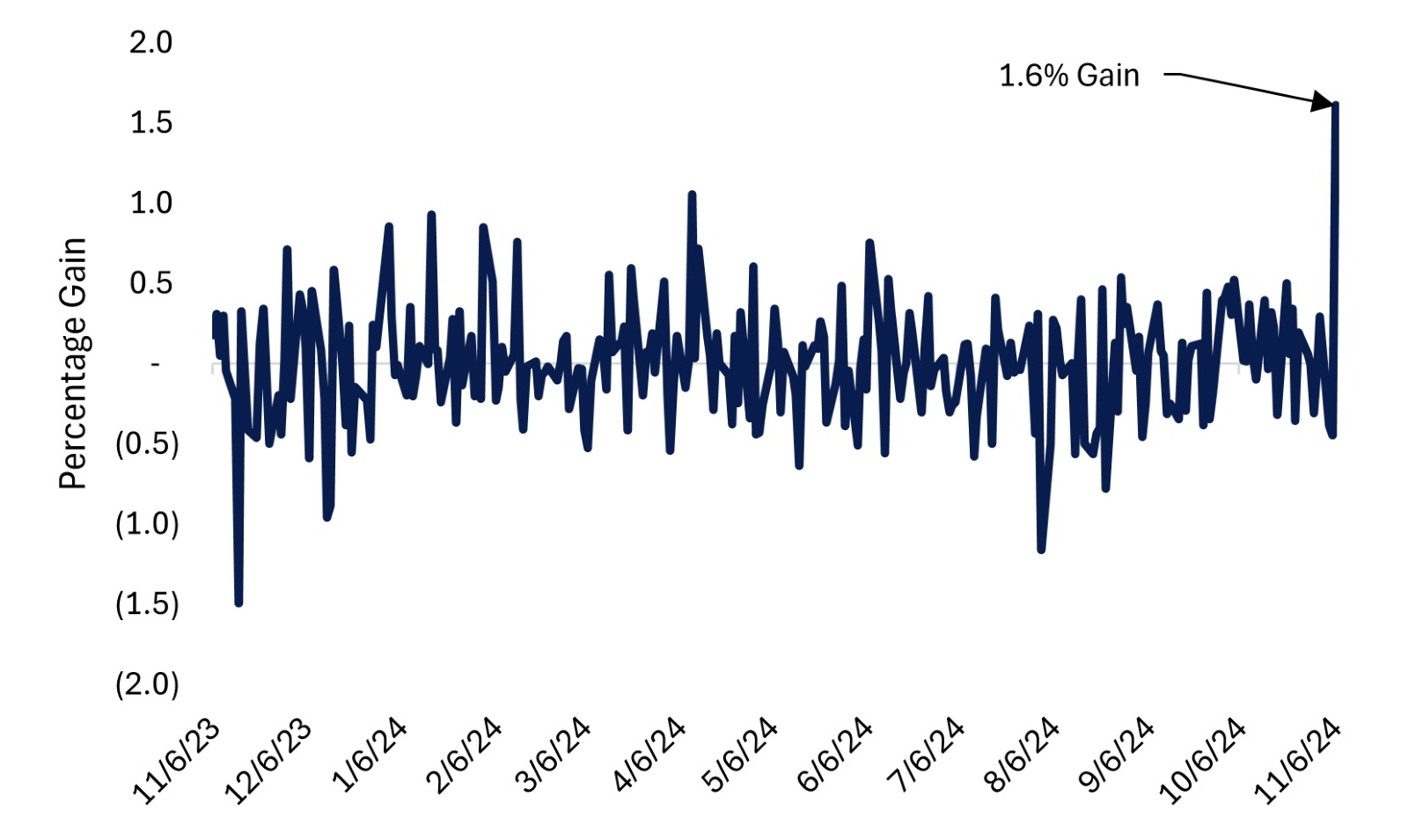

The chart below highlights the magnitude of the gain in the U.S. Dollar Index relative to the past 12 months.

U.S. Dollar Index Gains

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

U.S. Equities

Immediately following the election results, stocks hit all-time highs amid optimism from equity investors. The Dow Jones Industrial Average rose the most among the three major indexes. The price-weighted index saw over 5% and 13% returns from its top two weighted constituents. Small cap stocks enjoyed their biggest one-day gain of the year on November 7, with the Russell 2000 Index finishing higher by over 5.8%, nearly doubling the index’s 3.1% gain after Trump won in 2016. Small caps are seen as beneficiaries of Trump’s protectionist policies, which largely insulate domestic-focused companies from tariffs and trade strife. Overall, domestic stocks benefited from sentiment that the president elect will usher in pro-growth policies of deregulation and lower corporate tax rates. LPL Research maintains its tactical overweight positioning to U.S. equities versus non-U.S. as the domestic growth and policy landscape appears more attractive.

International Equities

Non-U.S. equities took the brunt of the “Trump Trade” selling as the MSCI EAFE and Emerging Markets indexes fell by 1.3% and 0.6%, respectively, following election day. No surprise here; the prospect for increased tariffs drove foreign stocks lower. In a bid to make domestic producers more competitive, the market initially soured on non-U.S. stocks. The depth and viability of tariff policy remains to be seen, however. Will campaign rhetoric manifest itself into actual policy, or will we see a more nuanced approach to global trade from the incoming administration? For now, we see overall weakness in foreign stocks versus their U.S. counterparts as European growth has slowed and a stronger U.S. dollar presents challenges for emerging markets. LPL Research favors an underweight to emerging markets, although valuations are attractive at this point and more stimulus from China is forthcoming.

Yields

Bond yields jumped higher with the 10-year U.S. Treasury rate climbing 16 basis points (bps), finishing November 6 at 4.43%. Yields had been moving higher into the election with the prospect of increased spending from both candidates and better-than-expected economic data. News of the Trump victory did little to assuage bond investors’ fears as potential tariffs caused worries of renewed inflation. Target rate probabilities for a 25-basis point rate cut by the Federal Reserve (Fed) on November 7 inched higher, remaining a near certainty. However, traders pared back future rate cut expectations, with consensus coming in at roughly four 0.25% cuts by the end of 2025. Bond markets seem to be exercising caution here, tempering equity market enthusiasm. The good news is that this presents more attractive starting yields for bond investors who are looking to deploy excess cash.

Financials

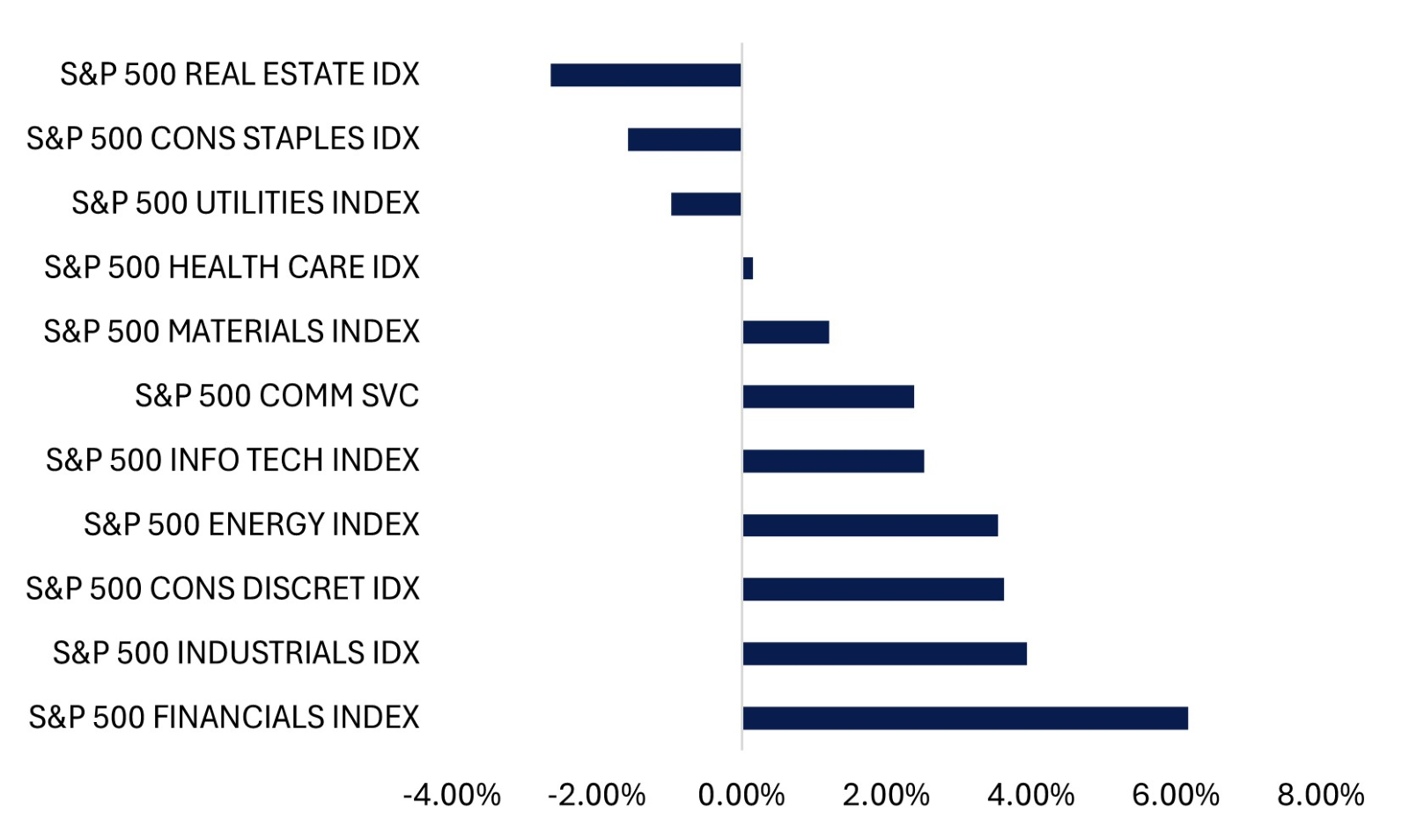

The financial services sector led all S&P 500 sectors initially following the election results. General sentiment is that a Trump administration would ease regulations on the heavily scrutinized sector, allowing companies to operate more freely. Mergers and acquisitions, which have been largely dormant recently, are expected to increase returns for bank stocks as a presumed Republican majority in Congress is seen to bias towards a more business-friendly environment. Financials have emerged favorably for LPL Research amid a constructive technical backdrop and an expected softening regulatory environment.

The chart below shows one-day returns of the 11 S&P 500 sectors following Election Day, led by financial services.

Source: LPL Research, Bloomberg 11/06/24

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Conclusion

Perhaps the biggest takeaway, aside from what we’ve highlighted here, is the lifting of the shroud of uncertainty. Markets love clarity, and they were granted exactly that in an expedient and demonstrable way following this election cycle. These events will take time to digest, and one single day should not be taken as a definite precursor to the future; however, the idea that the markets can now work without the burden of uncertainty should be welcomed by all investors.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

The Standard & Poor’s 500 (S&P 500) is a stock market index containing the stocks of 500 American corporations with large market capitalization that are considered to be widely held.

This research material has been prepared by LPL Financial LLC.

For Public Use – Tracking: #655468

Internal Tracking: #661292