Presidential Election: Market Impact

How do presidential elections impact the markets?

With news headlines constantly covering every aspect of the presidential race, you may be wondering how the 2024 election may impact you and your finances. After all, every four years, uncertainty about the next president and their economic policies can lead to more uncertainty in the minds of investors.

The long and short of it is you may care passionately about who wins, but your investment portfolio probably doesn’t.

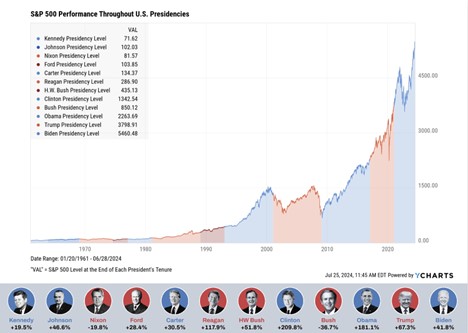

As this chart shows, while the stock market has fluctuated under the leadership of both parties, the S&P 500 has trended higher over the long term, no matter who’s in office. The trend suggests that the stock market's performance may have more to do with the overall strength and resiliency of the U.S. economy rather than the person who sits in the Oval Office.1

-

Long-Term Trend: Historical data shows that the stock market has generally trended higher over time, regardless of which party holds the presidency.

-

Company Growth: Many successful companies were founded and flourished under various administrations, contributing to overall economic strength.

-

Market Priorities: Factors like earnings growth, economic trends, and technological innovations typically influence the market more than political shifts.

-

Investor Focus: Remember, when you invest in the stock market, you're investing based on your time horizon, risk tolerance, and specific goals—not specific political outcomes.

The most important takeaway: While elections may create short-term fluctuations, historical trends suggest that long-term market performance is often driven by broader economic factors. Stay focused on your investment strategy, and let history guide your decisions.

If you have additional questions on how the market might influence your portfolio and broader plans, please contact your Wealth Advisor directly.

Stocks are measured by the Standard & Poor's 500 Composite Index, an unmanaged index considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. Stock price returns and principal values will fluctuate as market conditions change. Shares, when sold, may be worth more or less than their original cost.

1Chart Source: https://go.ycharts.com/hubfs/How_Do_Presidential_Elections_Impact_the_Market/Election_Guide.pdf

The professionals at Old National Investments are affiliated with LPL Financial, a leading independent broker/dealer and registered investment advisor. The content of this article was written by FMG Suite LLC. These are the views of FMG Suite LLC, and not necessarily those of the named wealth advisor nor Old National Investments and should not be construed as investment advice. Neither the named wealth advisor nor Old National Investments gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult a financial professional for further information. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. Consult your financial professional before making any investment decision.